Raise funds by ICO

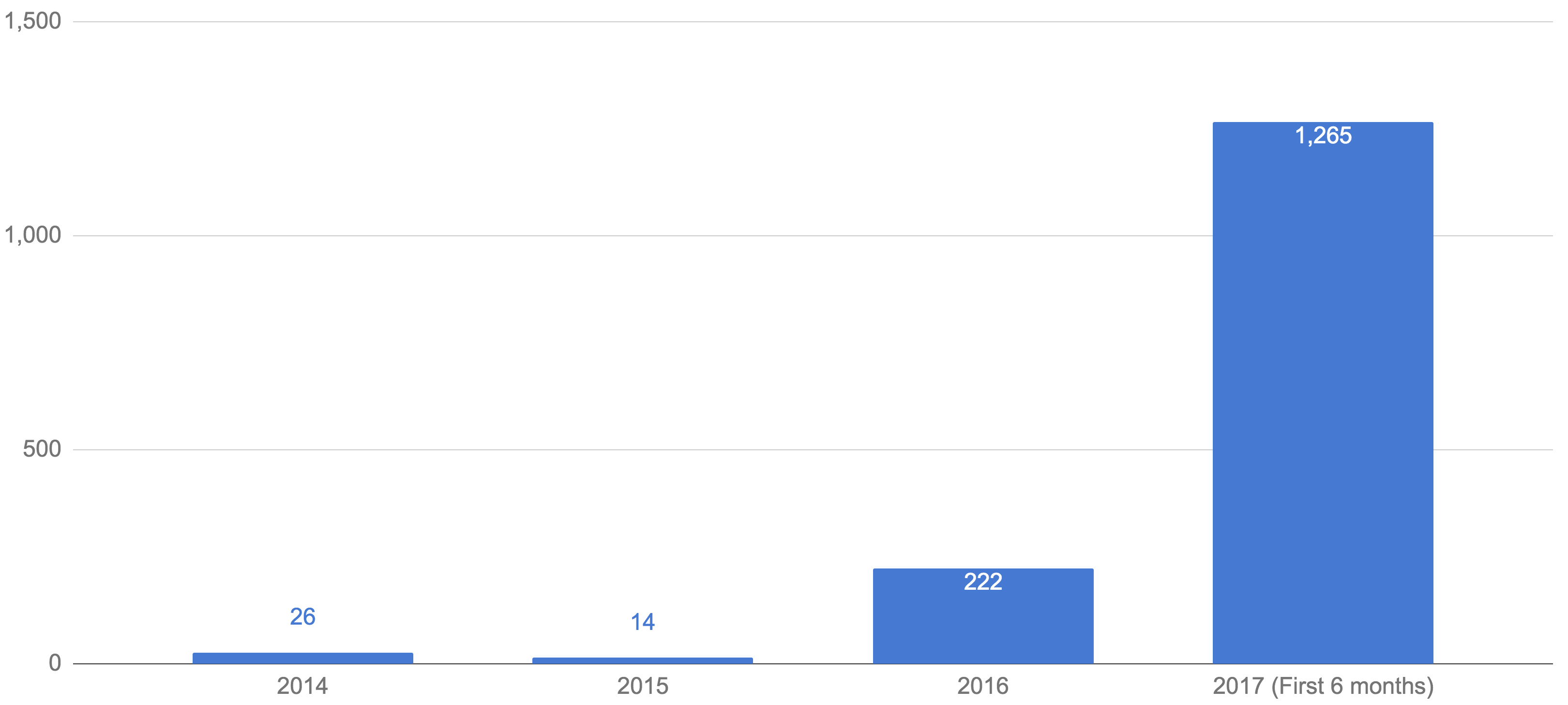

Inicial Coin Offering (ICO) is a new form of project financing that startups can raise money by cryptocurrencies. The ICO market is growing from 26M USD in 2014 to 1,265M USD in the first 6 months of 2017.

ICO investment volume by year ($ Million)

ICO and IPO

Initial Public Offering (IPO) is the traditional method of large-scale fundraising. It is a splendid system, but founders have to spend a lot of time convincing several people like venture capitalists. On the other hand, ICO is more user-friendly and decentralized. If users understand your business potential, they can invest it instantly.

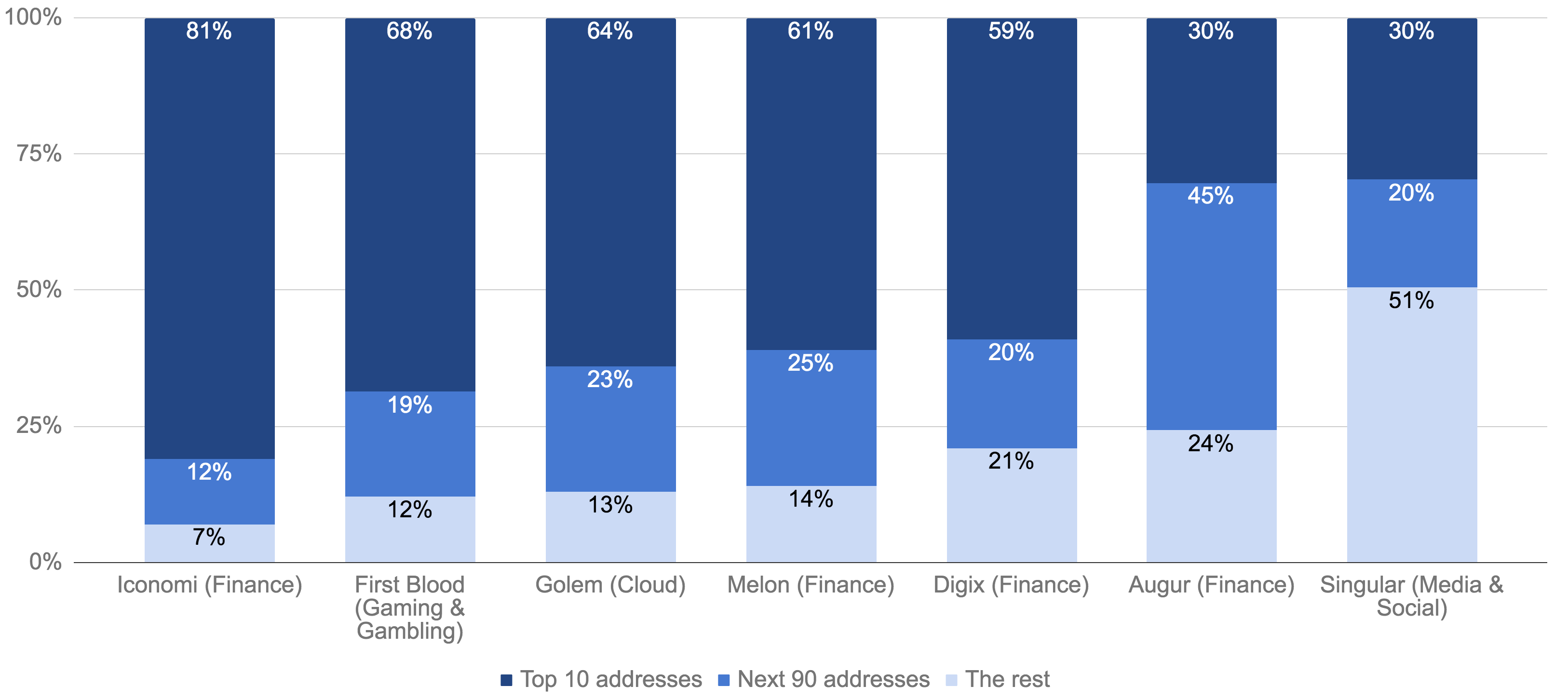

The following chart is the distribution of investments. Although the top 10 addresses own more than half tokens in many cases, they are open to minorities.

Distribution of investments among players

Please note that an ICO process is currently under consideration by jurisdictions. You should take care to legal aspects of ICOs. (e.g. The SEC has charged two initial coin offerings with defrauding investors)

ICO by Kik

Kik, the Canada-based creater of a chat platform, raised nearly 100M USD in the Kin token distribution event. It has involved more than 10,000 people from 117 countries. Ted Livingston, founder and CEO of Kik, said;

We wanted as many people as possible to participate in the Kin token distribution event. Based on the outpouring of support leading up to and during the event, we clearly achieved that goal. … We envision Kin as the foundation for a decentralized ecosystem of digital services, starting with Kik, and we couldn’t be more thrilled than to build this new future together with you.

This is a position paper about the Kin token. The keyword is “a decentralized ecosystem of digital services for daily life”. It includes Kik’s vision, the Kin foundation, technical considerations, and so on. This kind of information is essential for ICO because the targets are not only venture capitalists, but also everyday people like crowdfunding.